Yesterday, the Federal Reserve announced that they will not continue supporting the mortgage market and low interest rates. Watch today’s video as I give details and how this will impact purchase and refinance loans!

Category: Oregon Title Companies

-

Investors are Buying Homes by the Thousands – why this should matter to you!

Major investment groups are currently spending hundreds of millions buying rental homes. Watch today’s video as I share why this will impact your local market and how you can profit!

-

Take Action: Cost for FHA loans to rise next week!

A new survey is projecting an increase in new home sales by 2014. Watch today’s video as I explain why opportunity now exists for anyone wanting to make $$ in real estate. And, we are doing HARP 2.0 refinances in-house now!

-

Forget Mega-Millions … You can win the Home Loan Lottery!

Did you know that you are 20,000 times more likely to be in a car accident, than to win the lottery? But … almost everyone who calls about my Home Loan Lottery wins up to tens of thousands off their home loan … without paying any more monthly … Watch for details!

-

How to use “Gift Funds” to buy your next home!

Did you know that your relative, fiance, domestic partner, or even employer can “gift” you the money needed for your down-payment and closing costs? Watch today for details!

-

FHA costs rising in April – and HARP 2.0 refi program just got better!

If you need an FHA loan to buy a home or refinance, then you have until April 6th to call me, before the cost goes up. Plus, we have new updates on the HARP 2.0 government refi program, and it’s good news! Watch today’s video for details.

-

CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4, Calculatedriskblog.com

CoreLogic released the Q4 2011 negative equity report today.

CoreLogic … today released negative equity data showing that 11.1 million, or 22.8 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2011. This is up from 10.7 million properties, 22.1 percent, in the third quarter of 2011. An additional 2.5 million borrowers had less than five percent equity, referred to as near-negative equity, in the fourth quarter. Together, negative equity and near-negative equity mortgages accounted for 27.8 percent of all residential properties with a mortgage nationwide in the fourth quarter, up from 27.1 in the previous quarter. Nationally, the total mortgage debt outstanding on properties in negative equity increased from $2.7 trillion in the third quarter to $2.8 trillion in the fourth quarter.

“Due to the seasonal declines in home prices and slowing foreclosure pipeline which is depressing home prices, the negative equity share rose in late 2011. The negative equity share is back to the same level as Q3 2009, which is when we began reporting negative equity using this methodology. The high level of negative equity and the inability to pay is the ‘double trigger’ of default, and the reason we have such a significant foreclosure pipeline. While the economic recovery will reduce the propensity of the inability to pay trigger, negative equity will take an extended period of time to improve, and if there is a hiccup in the economic recovery, it could mean a rise in foreclosures.” said Mark Fleming, chief economist with CoreLogic.

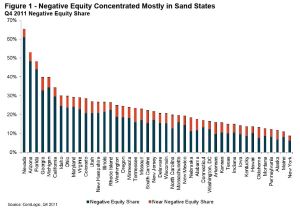

Here are a couple of graphs from the report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

“Nevada had the highest negative equity percentage with 61 percent of all of its mortgaged properties underwater, followed by Arizona (48 percent), Florida (44 percent), Michigan (35 percent) and Georgia (33 percent). This is the second consecutive quarter that Georgia was in the top five, surpassing California (29 percent) which previously had been in the top five since tracking began in 2009. The top five states combined have an average negative equity share of 44.3 percent, while the remaining states have a combined average negative equity share of 15.3 percent.”

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage – about 31% of homeowners nationwide do not have a mortgage.

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage – about 31% of homeowners nationwide do not have a mortgage.Some states – like New York – have a large percentage of borrowers with more than 20% equity, and Nevada, Arizona and Florida have the fewest borrowers with more than 20% equity.

Some interesting data on borrowers with and without home equity loans from CoreLogic: “Of the 11.1 million upside-down borrowers, there are 6.7 million first liens without home equity loans. This group of borrowers has an average mortgage balance of $219,000 and is underwater by an average of $51,000 or an LTV ratio of 130 percent.

The remaining 4.4 million upside-down borrowers had both first and second liens. Their average mortgage balance was $306,000 and they were upside down by an average of $84,000 or a combined LTV of 138 percent.”

Related articles

- 22.8 Percent of U.S. Homes Are Underwater (bingrealtygroup.wordpress.com)

- Number of Under Water Borrowers Rises (blogs.wsj.com)

- Housing Still Drowning in Underwater Mortgages (blogs.wsj.com)

- Two Thirds Of All Nevada Mortgages Are Underwater (zerohedge.com)

- Property market: How 2011 is shaping up (confused.com)

- There is ‘no silver bullet’ to address mortgage arrears, says financial regulator (teddyoshea.wordpress.com)

- Help for those trapped in negative equity (gateway-homes.co.uk)

- Mortgage delinquencies up in November, down for the year (agbeat.com)

- More Oregon, Portland-area mortgages underwater at year’s end (oregonlive.com)

- Why Those Pre Approval Letters Are So Important (nangoebel.wordpress.com)

-

America’s Credit and Housing Crisis: New State Bank Bills, Marketoracle.co.uk

Seventeen states have now introduced bills for state-owned banks, and others are in the works. Hawaii’s innovative state bank bill addresses the foreclosure mess. County-owned banks are being proposed that would tackle the housing crisis by exercising the right of eminent domain on abandoned and foreclosed properties. Arizona has a bill that would do this for homeowners who are current in their payments but underwater, allowing them to refinance at fair market value.

The long-awaited settlement between 49 state Attorneys General and the big five robo-signing banks is proving to be a majordisappointment before it has even been signed, sealed and court approved. Critics maintain that the bankers responsible for the housing crisis and the jobs crisis will again be buying their way out of jail, and the curtain will again drop on the scene of the crime.

We may not be able to beat the banks, but we don’t have to play their game. We can take our marbles and go home. The Move Your Money campaign has already prompted more than 600,000 consumers to move their funds out of Wall Street banks into local banks, and there are much larger pools that could be pulled out in the form of state revenues. States generally deposit their revenues and invest their capital with large Wall Street banks, which use those hefty sums to speculate, invest abroad, and buy up the local banks that service our communities and local economies. The states receive a modest interest, and Wall Street lends the money back at much higher interest.

Rhode Island is a case in point. In an article titled “Where Are R.I. Revenues Being Invested? Not Locally,” Kyle Hence wrote in ecoRI Newson January 26th:

According to a December Treasury report, only 10 percent of Rhode Island’s short-term investments reside in truly local in-state banks, namely Washington Trust and BankRI. Meanwhile, 40 percent of these investments were placed with foreign-owned banks, including a British-government owned bank under investigation by the European Union.

Further, millions have been invested by Rhode Island in a fund created by a global buyout firm . . . . From 2008 to mid-2010, the fund lost 10 percent of its value — more than $2 million. . . . Three of four of Rhode Island’s representatives in Washington, D.C., count [this fund] amongst their top 25 political campaign donors . . . .

Hence asks:

Are Rhode Islanders and the state economy being served well here? Is it not time for the state to more fully invest directly in Rhode Island, either through local banks more deeply rooted in the community or through the creation of a new state-owned bank?

Hence observes that state-owned banks are “[o]ne emerging solution being widely considered nationwide . . . . Since the onset of the economic collapse about five years ago, 16 states have studied or explored creating state-owned banks, according to a recent Associated Press report.”

2012 Additions to the Public Bank Movement

Make that 17 states, including three joining the list of states introducing state bank bills in 2012: Idaho (a bill for a feasibility study), New Hampshire (a bill for a bank), and Vermont (introducing THREE bills—one for a state bank study, one for a state currency, and one for a state voucher/warrant system). With North Dakota, which has had its own bank for nearly a century, that makes 18 states that have introduced bills in one form or another—36% of U.S. states. For states and text of bills, see here.

Other recent state bank developments were in Virginia, Hawaii, Washington State, and California, all of which have upgraded from bills to study the feasibility of a state-owned bank to bills to actually establish a bank. The most recent, California’s new bill, was introduced on Friday, February 24th.

All of these bills point to the Bank of North Dakota as their model. Kyle Hence notes that North Dakota has maintained a thriving economy throughout the current recession:

One of the reasons, some say, is the Bank of North Dakota, which was formed in 1919 and is the only state-owned or public bank in the United States. All state revenues flow into the Bank of North Dakota and back out into the state in the form of loans.

Since 2008, while servicing student, agricultural and energy— including wind — sector loans within North Dakota, every dollar of profit by the bank, which has added up to tens of millions, flows back into state coffers and directly supports the needs of the state in ways private banks do not.

Publicly-owned Banks and the Housing Crisis

A novel approach is taken in the new Hawaii bill: it proposes a program to deal with the housing crisis and the widespread problem of breaks in the chain of title due to robo-signing, faulty assignments, and MERS. (For more on this problem, see here.) According to a February 10th report on the bill from the Hawaii House Committees on Economic Revitalization and Business & Housing:

The purpose of this measure is to establish the bank of the State of Hawaii in order to develop a program to acquire residential property in situations where the mortgagor is an owner-occupant who has defaulted on a mortgage or been denied a mortgage loan modification and the mortgagee is a securitized trust that cannot adequately demonstrate that it is a holder in due course.

The bill provides that in cases of foreclosure in which the mortgagee cannot prove its right to foreclose or to collect on the mortgage, foreclosure shall be stayed and the bank of the State of Hawaii may offer to buy the property from the owner-occupant for a sum not exceeding 75% of the principal balance due on the mortgage loan. The bank of the State of Hawaii can then rent or sell the property back to the owner-occupant at a fair price on reasonable terms.

Arizona Senate Bill 1451, which just passed the Senate Banking Committee 6 to 0, would do something similar for homeowners who are current on their payments but whose mortgages are underwater (exceeding the property’s current fair market value). Martin Andelman callsthe bill a “revolutionary approach to revitalizing the state’s increasingly water-logged housing market, which has left over 500,000 ofArizona’s homeowners in a hopelessly immobile state.”

The bill would establish an Arizona Housing Finance Reform Authority to refinance the mortgages of Arizona homeowners who owe more than their homes are currently worth. The existing mortgage would be replaced with a new mortgage from AHFRA in an amount up to 125% of the home’s current fair market value. The existing lender would get paid 101% of the home’s fair market value, and would get a non-interest-bearing note called a “loss recapture certificate” covering a portion of any underwater amounts, to be paid over time. The capital to refinance the mortgages would come from floating revenue bonds, and payment on the bonds would come solely from monies paid by the homeowner-borrowers. An Arizona Home Insurance Fund would create a cash reserve of up to 20 percent of the bond and would be used to insure against losses. The bill would thus cost the state nothing.

Critics of the Arizona bill maintain that it shifts losses from collapsed property values onto banks and investors, violating the law of contracts; and critics of the Hawaii bill maintain that the state bank could wind up having paid more than market value for a slew of underwater homes. An option that would avoid both of these objections is one suggested by Michael Sauvante of the Commonwealth Group, discussed earlierhere: the state or county could exercise its right of eminent domain on blighted, foreclosed and abandoned properties. It could offer to pay fair market value to anyone who could prove title (something that with today’s defective title records normally can’t be done), then dispose of the property through a publicly-owned land bank as equity and fairness dictates. If a bank or trust could prove title, the claimant would get fair market value, which would be no less than it would have gotten at an auction; and if it could not prove title, it legally would have no claim to the property. Investors who could prove actual monetary damages would still have an unsecured claim in equity against the mortgagors for any sums owed.

Rhode Island Next?

As the housing crisis lingers on with little sign of relief from the Feds, innovative state and local solutions like these are gaining adherents in other states; and one of them is Rhode Island, which is in serious need of relief. According to The Pew Center on the States, “The country’s smallest state . . . was one of the first states to fall into the recession because of the housing crisis and may be one of the last to emerge.”

Rhode Islanders are proud of having been first in a number of more positive achievements, including being the first of the 13 original colonies to declare independence from British rule. A state bank presentation was made to the president of the Rhode Island Senate and other key leaders earlier this month that was reportedly well received. Proponents have ambitions of making Rhode Island the first state in this century to move its money out of Wall Street into its own state bank, one owned and operated by the people for the people.

Ellen Brown is an attorney and president of the Public Banking Institute, http://PublicBankingInstitute.org. In Web of Debt, her latest of eleven books, she shows how a private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her websites are http://WebofDebt.com and http://EllenBrown.com.

Ellen Brown is a frequent contributor to Global Research. Global Research Articles by Ellen Brown

© Copyright Ellen Brown 2012

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

http://www.marketoracle.co.uk/Article33365.html

Related articles

- Move Our Money: Should we create more state banks? (energybulletin.net)

- New State Bank Bills Address Credit and Housing Crises (webofdebt.wordpress.com)

- North Dakota bank eyed by cash-hungry politicians (sfgate.com)

- Rhode Island drops Fordham 78-58 (newsok.com)

- Structural Reform: The Case for Public State Banks (beavercountyblue.org)

- Rhode Island En Route To Upgrading Crappy Civil Unions To Real Gay Marriages (queerty.com)

- Forget Texas, check out North Dakota (skydancingblog.com)

- Economic struggles spur calls for public banking (usatoday.com)

- A legislative solution for RI’s compassion centers? (wrnihealthcareblog.wordpress.com)

-

Is The National Association Of Realtors Hurting The Real Estate Market? by Brett Reichel, Brettreichel.com

Yesterday, a fairly sophisticated home buyer called me about a pre-approval. He and his wife own a home, and a vacation home. This is a successful business couple who are doing well in the residential construction market despite the current economy. He indicated that they wanted to buy a new primary residence. His question to me was “We can get together about 10% down. Can we even buy a new home with less than 20% down?”

It’s no wonder they are confused. Every other article where leadership of the National Association of Realtors is quoted, every press release they issue usually has the quote that “tight lender guidelines are hurting the real estate market” or “buyers need to have 20% down and be perfect to accomplish a purchase” or some words like that.

Unfortunately, these types of statements are blatantly untrue in most markets, and are very damaging to the real estate market at large and to home buyers and sellers everywhere.

It’s true that lenders are giving loan applications MUCH greater scrutiny than they have in any time since 1998. Rampant mortgage fraud on the part of borrowers, Realtors, lenders, and mortgage originators have required lenders to check and recheck everything represented in a loan application. Unfortunatley, until we get everyone to realize that the “silly bank rules” they are breaking consititutes a federal crime we are stuck with the extra scrutiny. Fortunately, the new national loan originator licensing and registration systems should make loan officers everywhere realize the seriousness of this issue and root out fraud before it get’s to the point of a loan being funded. The safety of our banking and financial systems is too important to allow the kinds of games that have been played over the last few years.

The National Association of Realtors is right about appraisals. Appraisals remain a very serious issue. Pressure from Fannie Mae and Freddie Mac on lenders results in pressures by lending institutions on appraisers to bring in appraisals very conservatively. It’s common for appraisers to use inappropriate appraisal practice due to the Fannie Mae/Freddie Mac form1004mc, which results in innacurate appraisal (see previous posts).

It’s also true that underwriting guidelines are stricter than they were during the golden age of loose underwriting (1998 thru 2008). What people don’t realize that underwriting guidelines are easier now than they’ve been in any previous time frame. In fact, it’s a great time to buy for many folks who have been priced out of markets previously.

How can I make that type of claim? Because I remember the “bad old days”…..Prior to 1997-1998, debt-to-income ratio’s were much stricter than they are now. A debt-to-income ratio compares your total debt to your total income. In the old days, if you put 5% down on a conventional loan, you couldn’t have more than 36% of your total income go towards your debt. Now? If you’ve been reasonably careful with your credit, have decent job stability, and a little savings left over for emergency it’s pretty easy to get to a ratio of 41%! With only 5% down! On FHA loans, it’s really easy to go to 45% DTI with only 3.5% down! In fact, there are times that we go even higher.

Is that obvious in the mass media? No. They paint a dire picture based, in part, on the statements of NAR.

So, if you are a Realtor, press NAR to paint a more positve picture of financing. Nothing that is “puffed up”, just reality. If you are a buyer, don’t be fooled by what you read in the mainstream press. Talk to a good, local, independent mortgage banker. They’ll give you a clear path to home ownership and join the ranks of homeowners!

-

Refinancing your Underwater Fannie Mae home loan

The Fannie Mae DU Refi Plus home loan program is extended through this year and into 2012. This program may be able to help you refinance if you owe more than your home is worth. Check out this quick video:

The Fannie Mae DU Refi Plus – Basics

First of all, you need to make sure that your current loan is owned by Fannie Mae. You can check that at Fannie Mae’s website. All you need is your full address.

You also need to be on time with your mortgage payments. If you are behind in your mortgage, you will need to discuss loan modification or other options with your lender.

The biggest impediment when discussing the DU Refi Plus program is the issue of mortgage insurance. The best case scenario is if you do not have mortgage insurance on your current home loan.

If you need to figure out your options when it comes to refinancing your home in Oregon or Washington, shoot me an email. You may not always like the answer, but knowing is better than the alternative.

Thanks for taking a minute to check this post out!

Jason Hillard – homeloanninjas.com

Jason Hillard – homeloanninjas.comMortgage Advisor in Oregon and Washington MLO#119032

a div of Pinnacle Capital Mortgage Corp

503.799.4112

1706 D St Vancouver, WA 98663

NMLS 81395 WA CL-81395

-

Oregon’s Shadow Inventory – The “New Normal”?, by Phil Querin, Q-Law.com

The sad reality is that negative equity, short sales, and foreclosures, will likely be around for quite a while. “Negative equity”, which is the excess by which total debt encumbering the home exceeds its present fair market value, is almost becoming a fact of life. We know from theRMLS™ Market Action report that average and median prices this summer have continued to fall over the same time last year. The main reason is due to the volume of “shadow inventory”. This term refers to the amorphous number of homes – some of which we can count, such as listings and pendings–and much of which we can only estimate, such as families on the cusp of default, but current for the moment. Add to this “shadow” number, homes already 60 – 90 days delinquent, those already in some stage of foreclosure, and those post-foreclosure properties held as bank REOs, but not yet on the market, and it starts to look like a pretty big number. By some estimates, it may take nearly four years to burn through all of the shadow inventory. Digging deeper into the unknowable, we cannot forget the mobility factor, i.e. people needing or wanting to sell due to potential job relocation, changes in lifestyle, family size or retirement – many of these people, with and without equity, are still on the sidelines and difficult to estimate.

As long as we have shadow inventory, prices will remain depressed.[1] Why? Because many of the homes coming onto the market will be ones that have either been short sold due to negative equity, or those that have been recently foreclosed. In both cases, when these homes close they become a new “comp”, i.e. the reference point for pricing the next home that goes up for sale. [A good example of this was the first batch of South Waterfront condos that went to auction in 2009. The day after the auction, those sale prices became the new comps, not only for the unsold units in the building holding the auction, but also for many of the neighboring buildings. – PCQ]

All of these factors combine to destroy market equilibrium. That is, short sellers’ motivation is distorted. Homeowners with negative equity have little or no bargaining power. Pricing is driven by the “need” to sell, coupled with the lender’s decision to “bite the bullet” and let it sell. Similarly, for REO property, pricing is motivated by the banks’ need to deplete inventory to make room for more foreclosures. A primary factor limiting sales of bank REO property is the desire not to flood the market and further depress pricing. Only when market equilibrium is restored, i.e. a balance is achieved where both sellers and buyers have roughly comparable bargaining power, will we see prices start to rise. Today, that is not the case – even for sellers with equity in their homes. While equity sales are faster than short sales, pricing is dictated by buyers’ perception of value, and value is based upon the most recent short sale or REO sale.

So, the vicious circle persists. In today’s world of residential real estate, it is a fact of life. The silver lining, however, is that most Realtors® are becoming much more adept – and less intimidated – by the process. They understand these new market dynamics and are learning to deal with the nuances of short sales and REOs. This is a very good thing, since it does, indeed, appear as if this will be the “new normal” for quite a while.

Related articles

- Pre-Foreclosure Short Sales Jump 19% in Second Quarter by Carrie Bay, DSNEWS.com (oregonrealestateroundtable.com)

- Pre-Foreclosure Short Sales Jump 19% in Second Quarter (bingrealtygroup.wordpress.com)

- Home shadow inventory shrinks in July: CoreLogic (marketwatch.com)

- Housing crisis is not over (lansner.ocregister.com)

- Short Sale Mindset (velindapeyton.com)

- What is a Short Sale? And Other Commonly Asked Questions (mickeyknowsphilly.com)

- RealtyStore Reports First-Half 2010 Closes with More REO Foreclosure Inventory — REO Inventory Increases Expected through Q4 (prweb.com)

- Preferred Method of Home Liquidation by Banks – Short Sales Better Than Foreclosures (johnmurphyreports.com)

-

No End in Sight: Mortgage Loans Harder in High-Foreclosure Areas by Brian O’Connell, Mainstreet.com

NEW YORK (MainStreet) — Here’s another bitter pill for homeowners to swallow: If you live in an area with a high foreclosure rate, the chances of someone getting a loan to buy your house significantly decreases.

The news comes from the Federal Reserve’s latestreport, in which it concluded that mortgage lending was dramatically lower in communities and neighborhoods where foreclosures were surging, using data from the Neighborhood Stabilization Program (NSP) and from the Home Mortgage Disclosure Act (HMDA).

“Home-purchase lending in highly distressed census tracts identified by the Neighborhood Stabilization Program was 75% lower in 2010 than it had been in these same tracts in 2005,” the report said. “This decline was notably larger than that experienced in other tracts, and appears to primarily reflect a much sharper decrease in lending to higher-income borrowers in the highly distressed neighborhoods.”

The Fed uses the term “highly distressed” in place of the word “foreclosure”, but the message is clear: Banks and mortgage lenders are taking a big step back from lending to buyers who want a home in a high-foreclosure neighborhood.

It’s the same deal for borrowers who want to actually live in a home and buyers who want to purchase the property as aninvestment, as neither party seems to be having much luck in getting a home loan in a highly distressed neighborhood, according to the Fed. The lack of credit extended to investors could really hurt neighborhoods crippled by foreclosures.

“In the current period of high foreclosures and elevated levels of short sales, investor activity helps reduce the overhang of unsold and foreclosed properties,” the Federal Reserve says.

Overall, the Fed reports that 76% fewer mortgage loans were granted to “non-owner occupant” buyers in 2010, compared to 2005.

The Fed’s report reveals some other trends in the mortgage market:

- Mortgage originations declined from just under 9 million loans to fewer than 8 million loans between 2009 and 2010. Most significant was the decline in the number of refinance loans despite historically low baseline mortgage interest rates throughout the year. Home-purchase loans also declined, but less so than the decline in refinance lending.

- While loans originated under the Federal Housing Administration (FHA) mortgage insurance program and the Department of Veterans Affairs‘ (VA) loan guarantee program continue to account for a historically large proportion of loans, such lending fell more than did other types of lending.

- In the absence of home equity problems and underwriting changes, roughly 2.3 million first-lien owner-occupant refinance loans would have been made during 2010 on top of the 4.5 million such loans that were actually originated.

- A sharp drop in home-purchase lending activity occurred in the middle of 2010, right alongside the June closing deadline (although the deadline was retroactively extended to September). The ending of this program during 2010 may help explain the decline in the incidence of home-purchase lending to lower-income borrowers between the first and second halves of the year.

All in all, the report offers a pretty bleak – but even-handed and thorough – review of today’s home-purchase market.

Read more about the continuing effects of the housing crisis at MainStreet’s Foreclosure topic page.

Related articles

- Housing Slump Hits New Mortgage Loans (online.wsj.com)

- Mortgage Relief Scams Proliferate After Recession (scoppcanton.wordpress.com)

- Promoting Housing Recovery Parts 1 and 2, by Patrick Pulatie (oregonrealestateroundtable.com)

- Crash in Home Prices, Tight Lending Blocked 2.3 Million Refis (blogs.wsj.com)

- Homeowners Beware: Mortgage Mod Scammers Are Selling an Audit to Nowhere (dailyfinance.com)

- Ray Brescia: Return of the Incredible HOLC: How a Depression-Era Program Could Help Solve the Housing Puzzle (huffingtonpost.com)

- Fed Study: Low Mortgage Rates No Boon to Refinancing in 2010 (blogs.wsj.com)

-

The Meat of the Matter – In Re: Veal Analyzed, by Phil Querin, Q-Law.com

“When a note is split from a deed of trust ‘the note becomes, as a practical matter, unsecured.’ *** Additionally, if the deed of trust was assigned without the note, then the assignee, ‘having no interest in the underlying debt or obligation, has a worthless piece of paper.’” [In re Veal – United States Bankruptcy Appellate Panel of the Ninth Circuit (June 10, 2011)]

Introduction. This case is significant for two reasons: First, it was heard and decided by a three-judge Bankruptcy Appellate Panel for the Ninth Circuit, which includes Oregon. Second, it represents the next battleground in the continuing foreclosure wars between Big Banks and Bantam Borrowers: The effect of the Uniform Commercial Code (UCC”)on the transferability of the Promissory Note (or “Note”).

Remember, the Trust Deed follows the Note. If a lender is the owner of a Trust Deed, but cannot produce the actual Note which it secures, the Trust Deed is useless, since the lender is unable to prove it is owed the debt. Conversely, if the lender owns the Note, but not the Trust Deed, it cannot foreclose the secured property. [For a poetic perspective on the peripatetic lives of a Note and Trust Deed, connect here. – PCQ]

By now, most observers are aware that Oregon’s mandatory recording statute, ORS 86.735(1), has been a major impediment to lenders and servicers seeking trying to foreclose borrowers. Two major Oregon cases, the first in federal bankruptcy court, In re McCoy, and the other, in federal district trial court, Hooker v. Bank of America, et. al, based their decisions to halt the banks’ foreclosures, squarely on the lenders’ failure to record all Trust Deed Assignments. To date, however, scant mention has been made in these cases about ownership of the Promissory Note. [Presumably, this is because a clear violation of the Oregon’s recording statute is much easier to pitch to a judge, than having to explain the nuances – and there are many – of Articles 3 and 9 of the UCC. – PCQ]

Now we have In re: Veal, which was an appeal from the bankruptcy trial judge’s order granting Wells Fargo relief from the automatic stay provisions under federal bankruptcy law. Such a ruling meant that Wells Fargo would be permitted to foreclose the Veals’ property. But since this case arose in Arizona – not Oregon – our statutory law requiring the recording of all Assignments as a prerequisite to foreclosure, did not apply. Instead, the Veals’ lawyer relied upon the banks’ failure to establish that it had any right under the UCC to enforce the Promissory Note.

Legal Background. For reasons that do not need to be explained here, the Veals filed two contemporaneous appeals. One was against Wells Fargo Bank, which was acting as the Trustee for a REMIC, Option One Mortgage Loan Trust 2006–3, Asset–Backed Certificates Series 2006–3. In the second appeal, the Veals challenged the bankruptcy court’s order overruling their objection to a proof of claim filed by Wells Fargo’s servicing agent, American Home Mortgage Servicing, Inc. (“AHMSI”).

Factual Background. In August 2006, the Veals executed a Promissory Note and Mortgage in favor of GSF Mortgage Corporation (“GSF”). On June 29, 2009, they filed a Chapter 13 bankruptcy. On July 18, 2009, AHMSI filed a proof of claim, on behalf of Wells Fargo as its servicing agent. AHMSI included with its proof of claim the following documents:

- A copy of the Note, showing an indorsement[1] from GSF to “Option One”[2];

- A copy of the GSF’s Mortgage with the Veals;

- A copy of a recorded “Assignment of Mortgage” assigning the Mortgage from GSF to Option One; and,

- A letter dated May 15, 2008, signed by Jordan D. Dorchuck as Executive Vice President and Chief Legal Officer of AHMSI, addressed to “To Whom it May Concern”, stating that AHMSI acquired Option One’s mortgage servicing business.[3]

The Veals argued that AHMSI [Wells’ servicing agent] lacked standing since neither AHMSI or Wells Fargo established that they were qualified holders of the Note under Arizona’s version of the UCC.

In a belated and last ditch effort to establish its standing, Wells Fargo filed a copy of another Assignment of Mortgage, dated after it had already filed for relief from bankruptcy stay. This Assignment purported to transfer to Wells Fargo the Mortgage held by “Sand Canyon Corporation formerly known as Option One Mortgage Corporation”.

The 3-judge panel noted that neither of the assignments (the one from GSF to Option One and the other from Sand Canyon, Option One’s successor, to Wells) were authenticated – meaning that there were no supporting affidavits or other admissible evidence vouching for the authenticity of the documents. In short, it again appears that none of the banks’ attorneys would swear that the copies were true and accurate reproductions of the original – or that they’d even seen the originals to compare them with. With continuing reports of bogus and forged assignments, and robo-signed documents of questionable legal authority, it is not surprising that the bankruptcy panel viewed this so-called “evidence” with suspicion, and did not regard it as persuasive evidence.

- As to the Assignment of Mortgage from GSF (the originating bank) to Option One, the panel noted that it purported to assign not only the Mortgage, but the Promissory Note as well.[4]

- As to the Assignment of Mortgage from Sand Canyon [FKA Option One] to Wells Fargo[created after Wells Fargo’s motion for relied from stay], the panel said that the document did not contain language purporting to assign the Veals’ Promissory Note. As a consequence[even had it been considered as evidence], it would not have provided any proof of the transfer of the Promissory Note to Wells Fargo. At most, it would only have been proof that the Mortgage had been assigned.

After considerable discussion about the principles of standing versus real party in interest, the 3-judge panel focused on the latter, generally defining it as a rule protecting a defendant from being sued multiple times for the same obligation by different parties.

Applicability of UCC Articles 3 and 9. The Veal opinion is well worth reading for a good discussion of the Uniform Commercial Code and its applicability to the transfer and enforcement of Promissory Notes. The panel wrote that there are three ways to transfer Notes. The most common method is for one to be the “holder” of the Note. A person may be a “holder” if they:

- Have possession of the Note and it has been made payable to them; or,

- The Note is payable to the bearer [e.g. the note is left blank or payable to the “holder”.]

- The third way to enforce the Note is by attaining the status of a “nonholder in possession of the [note] who has the rights of a holder.” To do so, “…the possessor of the note must demonstrate both the fact of the delivery and the purpose of the delivery of the note to the transferee in order to qualify as the “person entitled to enforce.”

The panel concluded that none of Wells Fargo’s exhibits showed that it, or its agent, had actual possession of the Note. Thus, it could not establish that it was a holder of the Note, or a “person entitled to enforce” it. The judges noted that:

“In addition, even if admissible, the final purported assignment of the Mortgage was insufficient under Article 9 to support a conclusion that Wells Fargo holds any interest, ownership or otherwise, in the Note. Put another way, without any evidence tending to show it was a “person entitled to enforce” the Note, or that it has an interest in the Note, Wells Fargo has shown no right to enforce the Mortgage securing the Note. Without these rights, Wells Fargo cannot make the threshold showing of a colorable claim to the Property that would give it prudential standing to seek stay relief or to qualify as a real party in interest.”

As for Wells’ servicer, AHMSI, the panel reviewed the record and found nothing to establish that AHMSI was its lawful servicing agent. AHMSI had presented no evidence as to who possessed the original Note. It also presented no evidence showing indorsement of the Note either in its favor or in favor of Wells Fargo. Without establishing these elements, AHMSI could not establish that it was a “person entitled to enforce” the Note.

Quoting from the opinion:

“When debtors such as the Veals challenge an alleged servicer’s standing to file a proof of claim regarding a note governed by Article 3 of the UCC, that servicer must show it has an agency relationship with a “person entitled to enforce” the note that is the basis of the claim. If it does not, then the servicer has not shown that it has standing to file the proof of claim. ***”

Conclusion. Why is the Veal case important? Let’s start with recent history: First, we know that during the securitization heydays of 2005 – 2007, record keeping and document retention were exceedingly lax. Many in the lending and servicing industry seemed to think that somehow, MERS would reduce the paper chase. However, MERS was not mandatory, and in any event, it captured at best, perhaps 60% of the lending industry. Secondly, MERS tracked only Mortgages and Trust Deeds – not Promissory Notes. So even if a lender can establish its ownership of the Trust Deed, that alone is not enough, without the Note, to permit the foreclosure.

As recent litigation has revealed, some large lenders, such as Countrywide, made a habit of holding on to their Promissory Notes, rather than transferring them into the REMIC trusts that were supposed to be holding them. This cavalier attitude toward document delivery is now coming home to roost. While it may not have been a huge issue when loans were being paid off, it did become a huge issue when loans fell into default.

So should the Big Banks make good on their threat to start filing judicial foreclosures in Oregon, defense attorneys will likely shift their sights away from the unrecorded Trust Deed Assignments[5], and focus instead on whether the lenders and servicers actually have the legal right to enforce the underlying Promissory Notes.

[1] The word “indorsement” is UCC-speak for “endorsement” – as in “endorsing a check” in order to cash it.

[2] Although not perhaps as apparent in the opinion as it could have been, there were not successive indorsements of the Veals’ Promissory Note, i.e. from the originating bank to the foreclosing bank. There was only one, i.e. from GSF to Option One. There was no evidence that the Note, or the right to enforce it, had been transferred to Wells Fargo or AHMSI. Ultimately, there was no legal entitlement under the UCC giving either Wells or its servicer, AHMSI, the ability to enforce that Note. The principle here is that owning a borrower’s Trust Deed or Mortgage is insufficient without also owning, or have a right to enforce, the Promissory Note that it secures.

[3] Mr. Dorchuck did not appear to testify. His letter, on its face, is clearly hearsay and inadmissible. The failure to properly lay any foundation for the letter, or authenticate it “under penalty of perjury” is inexplicable – one that the bankruptcy panel criticized. This was not the only example of poor evidentiary protocol followed by the banks in this case. However, this may not be the fault of the banks’ lawyers. It is entirely possible these were the documents they had to work with, and they declined to certify under “penalty of perjury” the authenticity of them. If that is the case, one wonders how long good attorneys will continue to work for bad banks?

[4] This is a drafting sleight of hand. Mortgages and Trust Deeds are transferred by “assignment” from one entity to another. But Promissory Notes must be transferred under an entirely different set of rules – the UCC. Thus, to transfer both the Note and Mortgage by a simple “Assignment” document, is facially insufficient, by itself, to transfer ownership of – or a right to enforce – the Promissory Note.

[5] The successive recording requirement of ORS 86.735(1) only applies when the lender is seeking to foreclose non-judicially. Judicial foreclosures do not contain that statutory requirement. However, to judicially foreclose, lenders will still have to establish that they meet the standing and real party interest requirements of the law. In short, they will have to deal head-on with the requirements of Articles 3 and 9 of the Uniform Commercial Code. The Veal case is a good primer on these issues.

Phil Querin

Attorney at Law

http://www.q-law.com/

121 SW Salmon Street, Suite 1100 Portland, OR 97204

Tel: (503) 471- 1334Related articles

- ‘Robo-signing’ foreclosures haven’t gone away (msnbc.msn.com)

- Banks Continuing Dubious ‘Robo-Signing’ Foreclosure Practices: Investigation (huffingtonpost.com)

- Oregon Foreclosures: The Mess That MERS Made, by Phil Querin, Q-Law.com (oregonrealestateroundtable.com)

- assingmment please?? 2932.5 with a side of Veal (timothymccandless.wordpress.com)

-

Multnomahforeclosures.com: July 15th, 2011 Update.

Multnomahforeclosures.com was updated with the largest list of Notice Defaults to date. With Notice of Default records dating back nearly 3 years.

If you are planning on investing in real estate, want to learn the status of the home you are renting/leasing or about to rent or lease you should visit Multnomahforeclosures.com.

All listings are in PDF and Excel Spread Sheet format.

Multnomah County Foreclosures

Multnomah County Foreclosures

http://multnomahforeclosures.com

Fred Stewart

Broker

Stewart Group Realty Inc.

http://www.sgrealty.us/

info@sgrealtyinc.com

503-289-4970 (Phone)Related articles

- SG 18: Buyer Looking for Luxury Home and Can Close Quickly (oregonrealestatewanted.com)

-

PMI to pay underwater borrowers to stay put by by Jacob Gafney, Housingwire.com

Private mortgage insurer PMI Group (PMI: 1.34 -11.26%) will offer cash incentives to some homeowners in negative equity to help prevent mortgage defaults.

PMI subsidiary, Homeowner Reward is working with Loan Value Group, to administer the pilot program, called Responsible Homeowner Reward.

The program launched Monday and will start in select real estate markets where falling house prices left borrowers owing significantly more on their mortgage than what the property is worth.

Participation in RH Reward is voluntary and there is no cost to the homeowner, according to PMI. The cash will come after a lengthy period of keeping the mortgage current, generally from 36 to 60 months. According to PMI, the reward will be between 10 to 30% of the unpaid principal balance.

The Loan Value Group works “to positively influence consumer behavior on behalf of residential mortgage owners and servicers,” according to its website.

LVG programs already delivered more than $100 million in cash incentives to distressed homeowners. However, those programs focus on turnkey solutions such as cash for keys, with an aim to avoid principal forgiveness. The Homeowner Reward program is taking a different path.

“We continue to seek creative and effective loss mitigation strategies,” said Chris Hovey, PMI vice president of servicing operations and loss management. “PMI is especially supportive of homeownership retention efforts in states that are facing unprecedented housing challenges.”

Write to Jacob Gaffney.

Follow him on Twitter @jacobgaffney.

Related articles

- Unemployed homeowners get more relief (georgegmiller.wordpress.com)

- Big Banks Easing Terms on Loans Deemed as Risks (nytimes.com)

- Tax Breaks and Home Ownership (turbotax.intuit.com)

- Is Walking Away From Your Mortgage OK? (creditloan.com)

- U.S. tries to reduce more homeowners’ mortgages (thegreatone22.wordpress.com)

-

Bend’s economy is coming back to life, By Ben Jacklet, Oregon Business Magazine

Shelly Hummel has been selling homes in Bend for more than 20 years, and she’s got the attitude to match: upbeat, confident, a dog-lover who took up skiing at age 4. She labors to keep things positive, but every so often her frustration slips free: “The banks just kept giving the builders money, without even looking at plans or doing drive-bys of the places they were selling. The market just exploded with new construction. Boom! Selling stuff off of floor plans. Unfortunately, selling them to people who had no business buying them. It was a perfect storm of stupidity.”

We are touring the wreckage of that storm in Hummel’s Cadillac Escalade, driving down Brookswood Boulevard into a former pine forest that now hosts a swath of housing developments with names like Copper Canyon and Quail Pine. “This was the boundary line until 2003,” says Hummel. “These roads dead-ended. That home sold for $350,000. Now it’s on the market for $175,000. Short sale.”

Hummel never intended to become a “certified distressed property expert” specializing in selling homes for less than is owed on their mortgages. But in Bend, she didn’t have much of a choice. No city in Oregon — or arguably, the nation — experienced a more dramatic reversal of fortunes during the Great Recession than Bend, the economic engine for Central Oregon. Home values got cut in half. Unemployment soared to over 16%. A once-promising aviation sector imploded. So did an overheated market for destination resorts. Brokers, builders and speculators once flush with cash woke up underwater and flailing. Banks renowned for their no-document, easy-money loans stopped lending. Layoffs led to notices of default; foreclosure brought bankruptcy.

How does a community recover from economic meltdown? That is the central question I am trying to answer about Bend. I start my inquiry at the offices of Economic Development for Central Oregon (EDCO), an organization formed to diversify the economy after the last major recession in the region, in the 1980s. My meeting is with executive director Roger Lee, marketing manager Ruth Lindley and business development manager Eric Strobel. I turn on my digital recorder and say, “I’d like to hear your take on how the recession impacted Bend’s economy.”

Silence. I read their expressions: Not this again.

It takes some time, but over the course of the interview they paint a sharp portrait of what went wrong and why. A local housing boom “fueled by speculation, not solid economics,” in Lee’s words, crashed. The local crash coincided with a national housing slump that devastated Bend’s major traded sector of building supplies. The final blow was the collapse of the local general aviation industry. Cessna shut down its local plant in April 2009. Epic Aircraft, the other major employer at the airport, went bankrupt.

“Aviation was our diversification away from construction and wood products,” says Strobel. “We had thousands of employees out at Bend Airport. It was the largest aviation cluster in the state… It just completely fell apart in six months.”

Read more: Bend’s economy is coming back to life – Oregon Business http://www.oregonbusiness.com/articles/101-july-2011/5460-bends-economy-is-coming-back-to-life#ixzz1QVF66anh

Related articles

- People on the Move (bendbulletin.com)

-

Below Market Interest For Some Home Buyers Rate Available , by Brett Reichel, Brettreichel.com

If an interest rate below 4% is appealing to you, you should consider the Oregon State Bond Loan as an option in your next home purchase.

Yes – it can be used in a “next” situation. Though the program is a first time home buyer program, there are options for previous home owners to use this program. The Bond Loan defines a first time home buyer as someone who hasn’t owned a home in the last three years. So, if you owned a home, but sold it prior to 2007, it’s possible that you could qualify for this loan.

Currently, the State Bond Loan has an interest rate of 3.875%* and an APR of 4.721%*. These low interest rates might be a once in a lifetime opportunity.

The program is underwritten to FHA guidelines so it’s a pretty easy program to qualify for. FHA allows for less than perfect credit, and has flexible debt-to-income guidelines as well.

There are income limitations, but they are quite generous. You should plan on being a long term owner due to the potential “recapture” tax penalty (which isn’t automatic, nor is it as bad as many loan officers make it out to be).

Any “first time” home buyer should be considering this tool to minimize their housing expense!

*Based on a $200,000 sales price and $194,930 loan amount. Finance Charge $157,406.55, Amount Financed $190,935.08 and Total of Payments $348,341.73. Credit on approval. Terms subject to change without notice. Not a commitment to lend. Call for details. Equal Housing Lender.

Brett Reichel’s Blog http://www.brettreichel.com

Related articles

- Looking to Buy with a FHA or RD Loan – ACT NOW! (mortgageheathervt.wordpress.com)

- FHA Guidelines for Loan in Kentucky on a home (kentuckyfhaloan.wordpress.com)

- Six Questions to Ask Your Lender About a VA Loan (vabenefitblog.com)

- APR Can Cost You (bankerteam.com)

-

Use Caution When Selling REO Properties, by Phil Querin, PMAR Legal Counsel, Querin Law, LLC Q-Law.com

By now, most Realtors® have heard the rumblings about defective bank foreclosures in Oregon and elsewhere. What you may not have heard is that these flawed foreclosures can result in potential title problems down the road.

Here’s the “Readers Digest” version of the issue: Several recent federal court cases in Oregon have chastised lenders for failing to follow the trust deed foreclosure law. This law, found inORS 86.735(1), essentially says that before a lender may foreclose, it must record all assignments of the underlying trust deed. This requirement assures that the lender purporting to currently hold the note and trust deed can show the trail of assignments back to the original bank that first made the loan.

Due to poor record keeping, many banks cannot easily locate the several assignments that occurred over the life of the trust deed. Since Oregon’s law only requires assignment as a condition to foreclosing, the reality of the requirement didn’t hit home until the foreclosure crisis was in full swing, i.e. 2008 and after.

Being unable to now comply with the successive recording requirement, the statute was frequently ignored. The result was that most foreclosures in Oregon were potentially based upon a flawed process. One recent federal case held that the failure to record intervening assignments resulted in the foreclosure being “void.” In short, a complete nullity – as if it never occurred.

Aware of this law, the Oregon title industry is considering inserting a limitation on the scope of its policy coverage in certain REO sales. The limitation would apply where the underlying foreclosure did not comply with the assignment recording requirement of ORS 86.735(1). This means that the purchaser of certain bank-owned homes may not get complete coverage under their owner’s title policy. Since many banks have not generally given any warranties in their

REO deeds, there is a risk that a buyer will have no recourse (i.e. under their deed or their title insurance policy) should someone later attack the legality of the underlying foreclosure.

Realtors® representing buyers of REO properties should keep this issue in mind. While this is not to suggest that brokers become “title sleuths,” it is to suggest that they be generally aware of the issue, and mention it to their clients, when appropriate. If necessary, clients should be told to consult their own attorney. This is the “value proposition” that a well-informed Realtor® brings to the table in all REO transactions.

©2011 Phillip C. Querin, QUERIN LAW, LLC

Visit Phil Querin’s web site for more information about Oregon Real Estate Law http://www.q-law.com

Related articles

- Bank-Owned Backlog Still Building, by Carole VanSickle, Bryan Ellis Real Estate News Letter (oregonrealestateroundtable.com)

- Oregon Foreclosures: The Mess That MERS Made, by Phil Querin, Q-Law.com (oregonrealestateroundtable.com)

- Mr. Bevilacqua and the “Brooklyn Bridge Problem”, by Phil Querin, Q-Law.com (oregonrealestateroundtable.com)

- 10 Types of Companies Involved with Foreclosures (doorfly.com)

- Here Is What The Liberal Dems Have Done To The Housing Market, But They Stuck It To The Mortgage Companies (rantsandrage.com)

- The Neophyte’s Publication To Locating REO Properties In a Slow Market (pro2sell.com)

- Oregon Judge Denies Foreclosure, Challenges MERS (blogs.wsj.com)

- Oregon Foreclosures Jump 236% (maxredline.typepad.com)

- REO – Stay tuned, there’s more to come… (indeedwevest.wordpress.com)

- Assignment of Deed of Trust (heymarko.wordpress.com)

- Mortgage Recording ‘Fix’ Falls Short in Oregon (blogs.wsj.com)

- Bank of America Foreclosed On (epti.wordpress.com)