A new survey is projecting an increase in new home sales by 2014. Watch today’s video as I explain why opportunity now exists for anyone wanting to make $$ in real estate. And, we are doing HARP 2.0 refinances in-house now!

Tag: Federal Govenment

-

Forget Mega-Millions … You can win the Home Loan Lottery!

Did you know that you are 20,000 times more likely to be in a car accident, than to win the lottery? But … almost everyone who calls about my Home Loan Lottery wins up to tens of thousands off their home loan … without paying any more monthly … Watch for details!

-

How to use “Gift Funds” to buy your next home!

Did you know that your relative, fiance, domestic partner, or even employer can “gift” you the money needed for your down-payment and closing costs? Watch today for details!

-

FHA costs rising in April – and HARP 2.0 refi program just got better!

If you need an FHA loan to buy a home or refinance, then you have until April 6th to call me, before the cost goes up. Plus, we have new updates on the HARP 2.0 government refi program, and it’s good news! Watch today’s video for details.

-

Collecting GFE’s Isn’t the Best Way to Compare Mortgages

On a daily basis, I get calls from people who just want a Good Faith Estimate, as they are shopping for a mortgage loan. In today’s video, I explain why this isn’t the best practice and what you should do to get the best deal!

-

Have Dinner on Us for Next 30 Years!

How much do you spend when you go out to dinner with your family or friends? What if I could show you how I can cover that cost for the next 30 years? Watch today’s video for details!

-

What you should know about Mortgage Debt Forgiveness

Starting today, I will not be publishing rates online anymore. In this video, I explain why and how you can get an accurate refinance or purchase loan. Plus, some fact about Mortgage-Debt-Forgiveness that you should know! Get an accurate rate quote for your loan at www.GoNorthwestLoans.com

-

Buyer’s market forming – and why your mortgage rate doesn’t matter!

Big housing market shift has created more competition for those that want to buy homes. Watch for details, and I will also explain why the lowest interest rate isn’t always the best deal for you!

-

Buy your next home WITHOUT selling your current one first!

Many people believe the only way they can buy a new home, is by selling their existing one first. Not necessarily true, and your dream home might just be a phone call away!

-

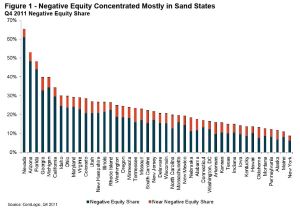

CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4, Calculatedriskblog.com

CoreLogic released the Q4 2011 negative equity report today.

CoreLogic … today released negative equity data showing that 11.1 million, or 22.8 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2011. This is up from 10.7 million properties, 22.1 percent, in the third quarter of 2011. An additional 2.5 million borrowers had less than five percent equity, referred to as near-negative equity, in the fourth quarter. Together, negative equity and near-negative equity mortgages accounted for 27.8 percent of all residential properties with a mortgage nationwide in the fourth quarter, up from 27.1 in the previous quarter. Nationally, the total mortgage debt outstanding on properties in negative equity increased from $2.7 trillion in the third quarter to $2.8 trillion in the fourth quarter.

“Due to the seasonal declines in home prices and slowing foreclosure pipeline which is depressing home prices, the negative equity share rose in late 2011. The negative equity share is back to the same level as Q3 2009, which is when we began reporting negative equity using this methodology. The high level of negative equity and the inability to pay is the ‘double trigger’ of default, and the reason we have such a significant foreclosure pipeline. While the economic recovery will reduce the propensity of the inability to pay trigger, negative equity will take an extended period of time to improve, and if there is a hiccup in the economic recovery, it could mean a rise in foreclosures.” said Mark Fleming, chief economist with CoreLogic.

Here are a couple of graphs from the report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

“Nevada had the highest negative equity percentage with 61 percent of all of its mortgaged properties underwater, followed by Arizona (48 percent), Florida (44 percent), Michigan (35 percent) and Georgia (33 percent). This is the second consecutive quarter that Georgia was in the top five, surpassing California (29 percent) which previously had been in the top five since tracking began in 2009. The top five states combined have an average negative equity share of 44.3 percent, while the remaining states have a combined average negative equity share of 15.3 percent.”

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage – about 31% of homeowners nationwide do not have a mortgage.

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage – about 31% of homeowners nationwide do not have a mortgage.Some states – like New York – have a large percentage of borrowers with more than 20% equity, and Nevada, Arizona and Florida have the fewest borrowers with more than 20% equity.

Some interesting data on borrowers with and without home equity loans from CoreLogic: “Of the 11.1 million upside-down borrowers, there are 6.7 million first liens without home equity loans. This group of borrowers has an average mortgage balance of $219,000 and is underwater by an average of $51,000 or an LTV ratio of 130 percent.

The remaining 4.4 million upside-down borrowers had both first and second liens. Their average mortgage balance was $306,000 and they were upside down by an average of $84,000 or a combined LTV of 138 percent.”

Related articles

- 22.8 Percent of U.S. Homes Are Underwater (bingrealtygroup.wordpress.com)

- Number of Under Water Borrowers Rises (blogs.wsj.com)

- Housing Still Drowning in Underwater Mortgages (blogs.wsj.com)

- Two Thirds Of All Nevada Mortgages Are Underwater (zerohedge.com)

- Property market: How 2011 is shaping up (confused.com)

- There is ‘no silver bullet’ to address mortgage arrears, says financial regulator (teddyoshea.wordpress.com)

- Help for those trapped in negative equity (gateway-homes.co.uk)

- Mortgage delinquencies up in November, down for the year (agbeat.com)

- More Oregon, Portland-area mortgages underwater at year’s end (oregonlive.com)

- Why Those Pre Approval Letters Are So Important (nangoebel.wordpress.com)

-

Mortgage market over-correction, or a sign of things to come?

In the past two days, mortgage rates have risen across the board by an average of 1/4%. This is significant and affects buying power & payments. Will this continue? Watch today as I give my predictions!

-

America’s Credit and Housing Crisis: New State Bank Bills, Marketoracle.co.uk

Seventeen states have now introduced bills for state-owned banks, and others are in the works. Hawaii’s innovative state bank bill addresses the foreclosure mess. County-owned banks are being proposed that would tackle the housing crisis by exercising the right of eminent domain on abandoned and foreclosed properties. Arizona has a bill that would do this for homeowners who are current in their payments but underwater, allowing them to refinance at fair market value.

The long-awaited settlement between 49 state Attorneys General and the big five robo-signing banks is proving to be a majordisappointment before it has even been signed, sealed and court approved. Critics maintain that the bankers responsible for the housing crisis and the jobs crisis will again be buying their way out of jail, and the curtain will again drop on the scene of the crime.

We may not be able to beat the banks, but we don’t have to play their game. We can take our marbles and go home. The Move Your Money campaign has already prompted more than 600,000 consumers to move their funds out of Wall Street banks into local banks, and there are much larger pools that could be pulled out in the form of state revenues. States generally deposit their revenues and invest their capital with large Wall Street banks, which use those hefty sums to speculate, invest abroad, and buy up the local banks that service our communities and local economies. The states receive a modest interest, and Wall Street lends the money back at much higher interest.

Rhode Island is a case in point. In an article titled “Where Are R.I. Revenues Being Invested? Not Locally,” Kyle Hence wrote in ecoRI Newson January 26th:

According to a December Treasury report, only 10 percent of Rhode Island’s short-term investments reside in truly local in-state banks, namely Washington Trust and BankRI. Meanwhile, 40 percent of these investments were placed with foreign-owned banks, including a British-government owned bank under investigation by the European Union.

Further, millions have been invested by Rhode Island in a fund created by a global buyout firm . . . . From 2008 to mid-2010, the fund lost 10 percent of its value — more than $2 million. . . . Three of four of Rhode Island’s representatives in Washington, D.C., count [this fund] amongst their top 25 political campaign donors . . . .

Hence asks:

Are Rhode Islanders and the state economy being served well here? Is it not time for the state to more fully invest directly in Rhode Island, either through local banks more deeply rooted in the community or through the creation of a new state-owned bank?

Hence observes that state-owned banks are “[o]ne emerging solution being widely considered nationwide . . . . Since the onset of the economic collapse about five years ago, 16 states have studied or explored creating state-owned banks, according to a recent Associated Press report.”

2012 Additions to the Public Bank Movement

Make that 17 states, including three joining the list of states introducing state bank bills in 2012: Idaho (a bill for a feasibility study), New Hampshire (a bill for a bank), and Vermont (introducing THREE bills—one for a state bank study, one for a state currency, and one for a state voucher/warrant system). With North Dakota, which has had its own bank for nearly a century, that makes 18 states that have introduced bills in one form or another—36% of U.S. states. For states and text of bills, see here.

Other recent state bank developments were in Virginia, Hawaii, Washington State, and California, all of which have upgraded from bills to study the feasibility of a state-owned bank to bills to actually establish a bank. The most recent, California’s new bill, was introduced on Friday, February 24th.

All of these bills point to the Bank of North Dakota as their model. Kyle Hence notes that North Dakota has maintained a thriving economy throughout the current recession:

One of the reasons, some say, is the Bank of North Dakota, which was formed in 1919 and is the only state-owned or public bank in the United States. All state revenues flow into the Bank of North Dakota and back out into the state in the form of loans.

Since 2008, while servicing student, agricultural and energy— including wind — sector loans within North Dakota, every dollar of profit by the bank, which has added up to tens of millions, flows back into state coffers and directly supports the needs of the state in ways private banks do not.

Publicly-owned Banks and the Housing Crisis

A novel approach is taken in the new Hawaii bill: it proposes a program to deal with the housing crisis and the widespread problem of breaks in the chain of title due to robo-signing, faulty assignments, and MERS. (For more on this problem, see here.) According to a February 10th report on the bill from the Hawaii House Committees on Economic Revitalization and Business & Housing:

The purpose of this measure is to establish the bank of the State of Hawaii in order to develop a program to acquire residential property in situations where the mortgagor is an owner-occupant who has defaulted on a mortgage or been denied a mortgage loan modification and the mortgagee is a securitized trust that cannot adequately demonstrate that it is a holder in due course.

The bill provides that in cases of foreclosure in which the mortgagee cannot prove its right to foreclose or to collect on the mortgage, foreclosure shall be stayed and the bank of the State of Hawaii may offer to buy the property from the owner-occupant for a sum not exceeding 75% of the principal balance due on the mortgage loan. The bank of the State of Hawaii can then rent or sell the property back to the owner-occupant at a fair price on reasonable terms.

Arizona Senate Bill 1451, which just passed the Senate Banking Committee 6 to 0, would do something similar for homeowners who are current on their payments but whose mortgages are underwater (exceeding the property’s current fair market value). Martin Andelman callsthe bill a “revolutionary approach to revitalizing the state’s increasingly water-logged housing market, which has left over 500,000 ofArizona’s homeowners in a hopelessly immobile state.”

The bill would establish an Arizona Housing Finance Reform Authority to refinance the mortgages of Arizona homeowners who owe more than their homes are currently worth. The existing mortgage would be replaced with a new mortgage from AHFRA in an amount up to 125% of the home’s current fair market value. The existing lender would get paid 101% of the home’s fair market value, and would get a non-interest-bearing note called a “loss recapture certificate” covering a portion of any underwater amounts, to be paid over time. The capital to refinance the mortgages would come from floating revenue bonds, and payment on the bonds would come solely from monies paid by the homeowner-borrowers. An Arizona Home Insurance Fund would create a cash reserve of up to 20 percent of the bond and would be used to insure against losses. The bill would thus cost the state nothing.

Critics of the Arizona bill maintain that it shifts losses from collapsed property values onto banks and investors, violating the law of contracts; and critics of the Hawaii bill maintain that the state bank could wind up having paid more than market value for a slew of underwater homes. An option that would avoid both of these objections is one suggested by Michael Sauvante of the Commonwealth Group, discussed earlierhere: the state or county could exercise its right of eminent domain on blighted, foreclosed and abandoned properties. It could offer to pay fair market value to anyone who could prove title (something that with today’s defective title records normally can’t be done), then dispose of the property through a publicly-owned land bank as equity and fairness dictates. If a bank or trust could prove title, the claimant would get fair market value, which would be no less than it would have gotten at an auction; and if it could not prove title, it legally would have no claim to the property. Investors who could prove actual monetary damages would still have an unsecured claim in equity against the mortgagors for any sums owed.

Rhode Island Next?

As the housing crisis lingers on with little sign of relief from the Feds, innovative state and local solutions like these are gaining adherents in other states; and one of them is Rhode Island, which is in serious need of relief. According to The Pew Center on the States, “The country’s smallest state . . . was one of the first states to fall into the recession because of the housing crisis and may be one of the last to emerge.”

Rhode Islanders are proud of having been first in a number of more positive achievements, including being the first of the 13 original colonies to declare independence from British rule. A state bank presentation was made to the president of the Rhode Island Senate and other key leaders earlier this month that was reportedly well received. Proponents have ambitions of making Rhode Island the first state in this century to move its money out of Wall Street into its own state bank, one owned and operated by the people for the people.

Ellen Brown is an attorney and president of the Public Banking Institute, http://PublicBankingInstitute.org. In Web of Debt, her latest of eleven books, she shows how a private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her websites are http://WebofDebt.com and http://EllenBrown.com.

Ellen Brown is a frequent contributor to Global Research. Global Research Articles by Ellen Brown

© Copyright Ellen Brown 2012

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

http://www.marketoracle.co.uk/Article33365.html

Related articles

- Move Our Money: Should we create more state banks? (energybulletin.net)

- New State Bank Bills Address Credit and Housing Crises (webofdebt.wordpress.com)

- North Dakota bank eyed by cash-hungry politicians (sfgate.com)

- Rhode Island drops Fordham 78-58 (newsok.com)

- Structural Reform: The Case for Public State Banks (beavercountyblue.org)

- Rhode Island En Route To Upgrading Crappy Civil Unions To Real Gay Marriages (queerty.com)

- Forget Texas, check out North Dakota (skydancingblog.com)

- Economic struggles spur calls for public banking (usatoday.com)

- A legislative solution for RI’s compassion centers? (wrnihealthcareblog.wordpress.com)

-

Financial Force Majeure

Financial Force Majeure: The Virtual World Taylored to Our Real World

If any of you have ever played the virtual reality game, Sim City or any similar, you will probably appreciate the point to be made more immediately than those unfamiliar. For the unfamiliar, this is a game in which you are the master of the land, tasked with taking what amounts to any empty field and building, expanding, and developing yourself a thriving metropolis.

This entails tapping into the natural resources that are available within your splotch of land, thereby harnessing those resources to grow your community. As master of your domain, you have to the politician, the banker, the shopkeeper too, making wise decisions with your electronic currency inasmuch as budgeting and investment are concerned. You have to provide the infrastructure, exploiting what resources you have to attract more Sims (the inhabitants of your city) to further grow your town.

You zone the land for residential, commercial, and industrial zones and providing for greenbelt, park, and recreational zones. You build schools, banks, retail and shopping centers, single-family and multi-family residential, industrial, and hospitals. As in the real world, this is done through various types of investment deals in the both the private and public sectors, involving commercial and investment banks, private investors and businesses. Your metropolis’ success depends on good investment strategies.

Mother Nature is an ever present threat, just as in the real world, throwing a natural disaster your way now and again. Of course, disaster strikes when least expected, testing the validity of your decisions, most of all your infrastructure. It is than you discover if value engineering the levy walls was such a good idea. Should news of cutting corners for costs leaks out, it costs your city, as restitution to flood victims is yours to bear.

Of course, the entirety is based on a designed program consisting of a language, codes, and locks. As with any program there savvy programmers, some might say hackers, having the learned knowledge to manipulate codes, language, and changing locks or even to remove locks. Purposes in hacking games might be to expand the games capabilities or to be able to be able to skip ahead to more advanced levels without having to play through the levels not desired.

Virtual reality games are rooted in fantasy, even if based on real situations, there is no tangible result. Emotional personal satisfaction or perhaps of monetary award if in some sort of competition is the best reward one can hope for. You can’t physically walk the streets of your city, go to one of its schools, or benefit from the investment dividends in terms of attaining real dollars.

For the developers, the tangible aspects are realized by sales which return in real dollars to the owners of the rights to the game. The developers might not necessarily be the owners either, depending on whether the developers retain rights or assigned them away to another.

The point to take away from this little piece is more of a question. What if, with highly sophisticated programming, it was possible to design investment strategies, for instance and than somehow apply them to the real world? What if it has already been done…..What if our whole entire economy has been modeled in the virtual world, brought forth into the real world?

Sound ridiculous? ………think again…….

INFORMATION PROCESSING SYSTEM FOR SEAMLESS VIRTUAL TO REAL WORLD OPERATIONS

US Patent Pub. No.: US 2002/0188760 Al

SECURING CONTRACTS IN A VIRTUAL WORLD

US Patent Pub. No.: US 2007/0117615

WEB DEPENDENT CONSUMER FINANCING AND VIRTUAL RESELLING METHOD

US Patent Pub. No.: US 2001/0056399 A1

TRANSACTIONS IN VIRTUAL PROPERTY

US Patent Pub. No.: US 2005/0021472 Al

VIRTUAL FINANCE/INSURANCE COMPANY

US Patent Pub. No.: US 2003/0187768 A1

-

MERS

What we need to do is take a survey, the population being made up of mortgage borrowers between the years 2002-2008. Why these years would become apparent with the results, which can be predicted before ever tallying the results. It would be a one question survey:

“Upon loan origination, was it required, in addition to completing a loan 1003 loan application, that you also provide specific documents for verification and loan qualification purposes, or did you simply have to complete a loan 1003 loan application?”

My bet would be that most everyone who was in receipt of a loan prior to September 2005 was required to submit documents to a human person which were used to verify loan qualification. Most nearly everyone subsequent that date was not required to submit anything by way of supporting documents.

This gives us two separately defined groups:

GROUP A: borrowers whose loans were humanly underwritten and verified

GROUP B: borrowers whose loans were underwritten entirely by automation

We can argue about the underlying reasons for economic collapse all day long, as there are certainly many, but one fact remains as being integral. This is acknowledging that there were borrowers that never, ever should have been approved for a loan, yet were. It was this very small subset of borrowers in Group B however, those that defaulted nearly immediately, that is within the first through third months out of the gate. It was these ‘early payment defaults (EPD’s ) that spread throughout the investment community causing fear, bringing into question the quality of all loan originations, thereby freezing the credit markets in August 2007, a year later the entire economy collapsed.

Of course, it is much more complex than that, but the crucial piece that provided the catalyst was these EPD’s. It was the quality of the borrowers from these EPD’s that became the model by which was used to stigmatize all borrowers. What was needed was a fall guy, to first lessen the anger towards the bailouts in providing a scapegoat, and second to divert attention away from the facts underlying the lending standards the failed and/or intentionally purposeful failure of the automation. From my research, it was with purposeful intent come hell or high water is my mission in life to bring forth into the public light.

Putting intent aside for the moment and just focusing on the EPD’s and the domino effect they caused which resulted in millions of borrowers, from both Groups A and B, to lose their homes or struggling to hold on. How could one small group of failed borrowers affect millions of other borrowers, especially those who were qualified through the traditional methods of underwriting?

The answer is an obvious one, coming down to the one common element that is the structuring of the loan products, that as it relates to the reset. Anyone whose reset occurred just prior and certainly after the economic collapse was as the saying goes…..Screwed. It is within is this, that the Grand Illusion lay intentionally concealed and hidden. It is within the automation wherein all the evidence clearly points to the fact that a mortgage is not a mortgage but rather a basket of securities….Not just any securities, but debt defaultable securities. In other words, it was largely planned to intentionally give loans to those whom were known to result in default.

But, even without understanding any of the issues as to the ‘basket of securities” there is one obvious point that looms, hiding in plain sight, which I believe should be completely exploited. This as it directly relates to our mortal enemy, that which takes the name of MERS. I know there are those that disseminate the structure of Mortgage Electronic Registration Systems, Inc and Merscorp as it relates to the MIN number and want to pick it apart, and all this is well and good. However, they miss the larger and more obvious point that clearly gives some definition.

There is one particular that every one of those millions upon millions of borrowers, those in both Group A and Group B along with the small subset of Group B, all have in common. ……MERS. MERS was integrated into every set of loan documents, slide past the borrowers without explanation without proper representation in concealing the implied contracts behind the trade and service mark of MERS.

MERS does not discriminate between a good or a bad loan, a loan is a loan as far it is concerned, whether it was fraudulently underwritten or perfectly underwritten. If it is registered with MERS the good, the bad, the ugly all go down, and therein lays an issue that is pertinent to discussion.

MERS was written into all Fannie and Freddie Uniform Security Instrument, not by happenstance, rather mandated by Fannie and Freddie. It was they who crafted verbiage and placement within the document. Fannie and Freddie are of course agency loans, however nearly 100% of non-agency lenders utilized the same Fannie and Freddie forms. Put into context, MERS covers both agency and non-agency, and not surprisingly members of MERS as well. Talk about fixing the game!!

It would seem logical, considering we, the American Taxpayer own Fannie Mae, that we should be entitled some answers to some very basic questions……The primary question: If Fannie Mae and Freddie Mac mandated that MERS play the role that it does, why than were there no quality control measures in place, and should they not have been responsible for putting in some safety measures in place?

The question is a logical one; any other business would have buried in litigation had a product it sponsored or mandated, as the case may be here, resulted in complete failure. From the standpoint of public policy, MERS was a tremendous failure. Why? The answer derives itself from the facts as laid out above regarding the underwriting processes and the division of borrowers: Group A and B.

This becomes a pertinent taking into account Fannie Mae on record in its recorded patents.

US PATENT #7,881,994 B1– Filed April 1, 2004, Assignee: Fannie Mae

‘It is well known that low doc loans bear additional risk. It is also true that these loans are

charged higher rates in order to compensate for the increased risk.’

System and method for processing a loan

US PATENT # 7,653,592– Filed December 30, 2005, Assignee: Fannie Mae

The following from the Summary section states:

‘An exemplary embodiment relates to a computer-implemented mortgage loan application data processing system comprising user interface logic and a workflow engine. The user interface logic is accessible by a borrower and is configured to receive mortgage loan application data for a mortgage loan application from the borrower. The workflow engine has stored therein a list representing tasks that need to be performed in connection with a mortgage loan application for a mortgage loan for the borrower. The tasks include tasks for fulfillment of underwriting conditions generated by an automated underwriting engine. The workflow engine is configured to cooperate with the user interface logic to prompt the borrower to perform the tasks represented in the list including the tasks for the fulfillment of the underwriting conditions. The system is configured to provide the borrower with a fully-verified approval for the mortgage loan application. The fully-verified approval indicates that the mortgage loan application data received from the borrower has already been verified as accurate using information from trusted sources. The fully-verified approval is provided in a form that allows the mortgage loan application to be provided to different lenders with the different lenders being able to authenticate the fully-verified approval status of the mortgage loan application’

Computerized systems and methods for facilitating the flow of capital

through the housing finance industry

US PATENT # 7,765,151– Filed July 21, 2006, Assignee: Fannie Mae

The following passages taken from patent documents reads:

‘The prospect or other loan originator preferably displays generic interest rates (together with an assumptive rate sheet, i.e., current mortgage rates) on its Internet web site or the like to entice online mortgage shoppers to access the web site (step 50). The generic interest rates (“enticement rates”) displayed are not intended to be borrower specific, but are calculated by pricing engine 22 and provided to the loan originator as representative, for example, of interest rates that a “typical” borrower may expect to receive, or rates that a fictitious highly qualified borrower may expect to receive, as described in greater detail hereinafter. FIG. 2b depicts an example of a computer Internet interface screen displaying enticement rates.’

’If the potential borrower enters a combination of factors that is ineligible, the borrower is notified immediately of the ineligibility and is prompted to either change the selection or call a help center for assistance (action 116). It should be understood that this allows the potential borrower to change the response to a previous question and then continue on with the probable qualification process. If the potential borrower passes the eligibility screening, the borrower then is permitted to continue on with the probable qualification assessment.’

‘Underwriting engine 24 also determines, for each approved product, the minimum amount of verification documentation (e.g., minimum assets to verify, minimum income to verify), selected loan underwriting parameters, assuming no other data changes, (e.g., maximum loan amount for approval, maximum loan amount for aggregating closing costs with the loan principal, and minimum refinance amount), as well as the maximums and minimums used to tailor the interest rate quote (maximum schedule interest rate and maximum number of points) and maximum interest rate approved for float up to a preselected increase over a current approved rate. It should be appreciated that this allows the potential borrower to provide only that information that is necessary for an approval decision, rather than all potentially relevant financial and other borrower information. This also reduces the processing burden on system.’

The two patents above was Fannie Mae’s means of responding to its competition, that being the non-agency who had surpassed the agencies in sales volume (those stats I will have to dig up and repost as they are not handy at the moment), as the non-agencies had dropped all standards back in and around September 2005.

The point being though, Fannie Mae and Freddie Mad were the caretakers of MERS, so to speak, inasmuch as mandating MERS upon the borrowers. Had there been safety measures in place that caught the fact that the loans that were dumping out quickly, that is the EPD’s, there might have been a stoppage in place, thereby preventing MERS from executing foreclosures upon every successive mortgage.

I know that this is all BS though, because it is a cover up, a massive one that cuts into the heart of the United States government. This is perhaps one avenue by which to get there, as the questions asked are easily understood, as opposed to digging into the automation processes which people apparently are not ready to accept as of yet.

-

Mass Court May Rule on Retroactivity of some Foreclosures Tied to ‘Naked Mortgages’, by Jann Swanson Mortgagenewsdaily.com

Another next major marker in the convoluted foreclosure landscape will probably come in the next few weeks when the Massachusetts Supreme Judicial Court (SJC) is expected to rule on Eaton v. Federal National Mortgage Association (Fannie Mae). This is another in a series of cases challenging the right of various lenders and nominees to foreclose on delinquent mortgages based on assertions that those parties do not own or at least cannot prove they own the enabling legal documents.

Eaton raises an additional point that has excited interest – whether or not that foreclosure can be challenged and compensation enforced on a retroactive basis or whether such retroactivity exacts too high a cost or permanently clouds title.

The details of the case are fairly standard, involving a note given by Henrietta Eaton to BankUnited and a contemporaneous mortgage to Mortgage Electronic Registration Systems (MERS). The mortgage was later assigned by MERS to Green Tree servicing and the assignment did not reference the note. The Eaton Home was subsequently foreclosed upon by Green Tree which assigned its rights under the foreclosure to Fannie Mae which sought to evict Eaton. Eaton sued, charging that the loan servicer did not hold the note proving that Eaton was obliged to pay the mortgage.

The Massachusetts Superior Court relied on a January, 2011 ruling in U.S. Bank V. Ibanez in which the court held that the assignment of a mortgage must be effective before the foreclosure in order to be valid and that as holder of the note separated from the mortgage due to a lack of effective assignment, the Plaintiffs had only a beneficial interest in the mortgage note and the power of sale statute granted foreclosure authority to the mortgagee, not to the owner of the beneficial interest.

In Eaton the lower court said it was “cognizant of sound reason that would have historically supported the common law rule requiring the unification of the promissory note and the mortgage note in the foreclosing entity prior to foreclosure. Allowing foreclosure by a mortgagee not in possession of the mortgage note is potentially unfair to the mortgagor. A holder in due course of the promissory note could seek to recover against the mortgagor, thus exposing her to double liability.”

In its brief to the Supreme Judicial Court, Fannie Mae contests the lower court ruling on the grounds that:

1. Requiring unity of the note and mortgage to foreclose would create a cloud on the Title and result in adverse consequence for Massachusetts homeowners.

2. A ruling requiring unity of the note and mortgage to conduct a valid foreclosure should be limited to prospective application only (because)

A. Such a ruling was not clearly foreshadowed and

B. Retroactive application could result in hardship and injustice.

The case has been the impetus for filings of nearly a dozen amicus briefs from groups such as the Land Title Association, Real Estate Bar Association, and foreclosure law firms, most in response to a SJC request for comment on whether any ruling should be applied retroactively and if so what the impact would be on the title of some 40,000 homes foreclosed in the last few years.

Of particular interest is a brief filed by the Federal Housing Finance Agency, conservator of both Fannie Mae and Freddie Mac which some observers said might be the first time the agency had intervened in a particular foreclosure case.

FHFA asked the court to apply any decision to uphold the lower court decision prospectively rather than retrospectively. It’s argument: applying a ruling retroactively would be “a direct threat to orderly operation of the mortgage market.” FHFA also said “Retroactive application of a decision requiring unity of the note and the mortgage for a valid foreclosure would impose costs on U.S. Taxpayers and would frustrate the statutory objectives of Conservatorship.”

“There presently is no mechanism or requirement under Massachusetts law to record the identity of the person entitled to enforce the note at the time of foreclosure,” FHFA said. “Therefore, a retroactive rule requiring unity of the note and mortgage for a valid foreclosure would potentially call into question the title of any property with a foreclosure in its chain of title within at least the last twenty years.”

A contrary opinion was advanced in a brief filed by Georgetown University Law School Professor Adam Levitin who called the ruling that a party cannot foreclose on a “naked mortgage” (one separated from the note) merely a restatement of commercial law and “to the extent that the mortgage industry has disregarded a legal principle so commonsensical and uncontroversial that it has been encapsulated in a Restatement, it does so at its peril.”

Levitin argues that it is impossible to know how widespread the problem of naked mortgages may be either in Massachusetts or nationwide so this should temper any evaluation of the impact of retroactivity. He also states that there are several factors “that should assuage concerns about clouded title resulting from a retroactively applicable ruling requiring a unity of the note and mortgage.” He points out that adverse possession, pleading standards, burdens of proof and equitable defenses such as laches all combine to make the likelihood of challenging past foreclosure unlikely and sharply limiting the retroactive effect of a ruling.

Kathleen M. Howley and Thom Weidlich, writing for Bloomberg noted that a decision to uphold the lower court “could lead to a surge in claims from home owners seeking to overturn seizures.”

According to Howley and Weidlich, the SJC ruled last year on two foreclosure cases that handed properties back to owners on naked mortgage grounds. The Ibanez case, referenced above dealt with two single family houses, but in Bevilacqua v. Rodriguez the court handed an apartment building back to the previous owner five years after the foreclosure. In the interim a developer had purchased the building and turned it into condos. The condo owners lost their units without compensation and the building now stands vacant.

The decision may be available before month’s end and as Massrealestateblog.com said, “For interested legal observers of the foreclosure crisis, it really doesn’t get any better than this”.

Related articles

- FHFA pushes for privatization of Fannie Mae, Freddie Mac (agbeat.com)

- Bank Exposure on Fraudulent Document Issues Still Active, Dangerous (news.firedoglake.com)

- Bank of America Cuts Off Fannie Mae (news.firedoglake.com)

- Realtors Slam Obama Foreclosure-Rental Plan (blogs.wsj.com)

- Plotting the Future of Fannie and Freddie (business.time.com)

-

Successful Short Sales: It All Starts with the Seller, by Gee Dunsten, Rismedia.com

RISMEDIA, Monday, February 13, 2012— Last month, I outlined the reasons why you should get back on the short sales bandwagon if you’ve fallen off. In the current market, more and more lenders are coming around to the realization that short sales are a favorable option after all and, therefore, are processing and closing short sales at a much faster pace.

That said, there are critical steps that must be taken throughout the short sale process.

First and foremost, make sure the home seller is truly eligible for a short sale. A credible, documented financial hardship resulting from a loss of employment, divorce, major medical crisis, death, etc., must exist. This financial hardship needs to be proven with proper documentation as well as detailed financial statements, paystubs, bank statements and tax returns.

To properly identify and qualify a potential short sale client, conduct a thorough interview right up front—and be sure to leave no stone unturned. This will prevent you from futilely pursuing a short sale with the lender. I use the following Short Sale Seller Questionnaire with my clients:

1. Is your property currently on the market? Is it listed with an agent?

2. Is this your primary residence?

3. When was the property purchased?

4. What was the original purchase price?

5. Who holds the mortgage?

6. What kind of loan do you have?

7. Do you have any other liens against your property?

8. Who is on the title (or deed) for the property?

9. Who is on the mortgage?

10. Do you have mortgage insurance?

11. Are you current with your payments? If not, how far in arrears are you?

12. How much do you owe?

13. Why do you need/want to sell?

14. What caused you or will be causing you to miss your mortgage payment obligation?

15. Do you have funds in accounts that could be used to satisfy the deficiency?

16. Are you currently living in the property? If not, is the property being maintained?

17. How soon do you need to move?

18. Are you up to date on your condo or HOA payments (where applicable)?

19. Do you owe any back taxes?

20. Are you considering filing for bankruptcy protection?

21. Are you currently pursuing a loan modification with your lender?

22. Who is occupying the property?

23. Do you hold or are you subject to any type of security clearance related to your job?

24. What are your plans after you sell?

25. Are you looking to receive any money from the sale of your home?

26. How much income are you currently making from all sources?

27. Do you anticipate any income change in the not-too-distant future?

28. Do you have a pen and a piece of paper to make a couple of notes?Emphasize that inaccurate or missing information will potentially delay or completely thwart the short sale process. Next month, we’ll take a close look at working with lenders to secure a short sale.

George “Gee” Dunsten, president of Gee Dunsten Seminars, Inc., has been a real estate agent and broker/owner for almost 40 years. Dunsten has been a senior instructor with the Council of Residential Specialists for more than 20 years. To reach Gee, please email, gee@gee-dunsten.com. For an extended version of this article, please visit www.rismedia.com.

Related articles

- After months of waiting finally banks are starting to approve short sales (danapointrealestateblog.wordpress.com)

- A New Term Called “Short Sale” – Guest Blogger Angie Riano (teamnia.wordpress.com)

- Short Sale – Ca… (chudwendle.wordpress.com)

- What Do Lenders Look For When Qualifying A Short Sale? (athomesense.wordpress.com)

- Mortgage workouts of the day, short-sale edition (blogs.reuters.com)

-

Has Housing Really Bottomed? Oftwominds.com

Massive intervention by Federal agencies and the Federal Reserve have kept the market from discovering price and the risk premium in real estate. That sets up a “catch the falling knife” possibility for impatient real estate investors.

A substantial percentage of many households’ net worth is comprised of the equity in their home. With the beating home prices have taken since 2007, existing and soon-to-be homeowners are keen to know: Are prices stabilizing? Will they begin to recover from here? Or is the “knife” still falling?

To understand where housing prices are headed, we need to understand what drives them in the first place: policy, perception, and price discovery.

In my December 2011 look at housing, I examined systemic factors such as employment and demographics that represent ongoing structural impediments to the much-awaited recovery in housing valuations and sales. This time around, we’re going to consider policy factors that influence the housing market.

Yesterday while standing in line at our credit union I overheard another customer at a teller’s window request that her $100,000 Certificate of Deposit (CD) be withdrawn and placed in her checking account because, she said, “I’m not earning anything.” The woman was middle-aged and dressed for work in a professional white- collar environment — a typical member, perhaps, of the vanishing middle class.

Sadly, she is doing exactly what Ben Bernanke’s Federal Reserve policies are intended to push people into doing: abandoning capital accumulation (savings) in favor of consumption or trying for a higher yield in risk assets such as stocks and real estate.

It may strike younger readers as unbelievable that a few decades ago, in the low-inflation 1960s, savings accounts earned a government-stipulated minimum yield of 5.25%, regardless of where the Fed Funds Rate might be. Capital accumulation was widely understood to be the bedrock of household financial security and the source of productive lending, whether for 30-year home mortgages or loans taken on to expand an enterprise.

How times — and the US economy — have changed.

Now the explicit policy of the nation’s private central bank (the Federal Reserve) and the federal government’s myriad housing and mortgage agencies is to punish saving with essentially negative returns in favor of blatant speculation with borrowed money. Official inflation is around 3% and savings accounts earn less than 0.1%, leaving savers with a net loss of about 3% every year. Even worse — if that is possible — these same agencies have extended housing lenders trillions of dollars in bailouts, backstops and guarantees, creating institutionalized moral hazard on an unprecedented scale.

Recall that moral hazard simply means that the relationship between risk and return and has been severed, so risk can be taken in near-infinite amounts with the assurance that if that risk blows up, the gains remain in the hands of the speculator. Another way of describing this policy of government bailouts is “profits are private but losses are socialized.” That is, any profits earned from risky speculation are the speculator’s to keep, while all the losses are transferred to the public.

While the housing bubble was most certainly based on a credit bubble enabled by lax oversight and fraudulent practices, the aftermath can be fairly summarized as institutionalizing moral hazard.

Policy as Behavior Modification and Perception Management

Quasi-official pronouncements by Fed Board members suggest that the Fed’s stated policy of punishing savers with a zero-interest rate policy (ZIRP) is outwardly designed to lower the cost of refinancing mortgages and buying a house. The first is supposed to free up cash that households can then spend on consumption, thereby boosting the economy. With savings earning a negative yield, consuming more becomes a tangibly attractive alternative. (How keeping the factories in Asia humming will boost the American economy is left unstated.)

This near-complete destruction of investment income from household savings yields a rather poor return. Plausible estimates of the total gain that could be reaped by widespread refinancing hover around $40 billion a year, which is not much in a $15 trillion economy.

There are real-world limits on this policy as well. Since the Fed can’t actually force lenders to refinance underwater mortgages, millions of homeowners are unable to take advantage of lower rates. From the point of view of lenders, declining household incomes and mortgages that exceed the home value (so-called negative equity) have lowered the creditworthiness of many homeowners.

As a result, the stated Fed policy goal of lowering mortgage payments to boost consumer spending has met with limited success. Somewhat ironically, the mortgage industry’s well-known woes — extended time-frames for involuntary foreclosure, lenders’ hesitancy to concede to short sales (where the house is sold for less than the mortgage and the lender absorbs a loss), and strategic/voluntary defaults — may be putting an estimated $80 billion in “free cash” that once went to mortgages into defaulting consumer’s hands.

The failure of the Fed’s policies to increase household’s surplus income via ZIRP leads us to the second implicit goal, lowering the cost of home ownership via super-low mortgage rates, which serves both as behavior modification and perception management. If low-interest rate mortgages and subsidized Federal programs that offer low down payments drop the price of home ownership below that of renting an equivalent house, then there is a substantial financial incentive to buy rather than rent.

The implicit goal is to shape a general perception that the bottom is in, and it’s now safe to buy housing.

First-time home buying programs and FHA (Federal Housing Authority) and VA (Veterans Administration) loans all offer very low down-payment options to qualified buyers. This extends a form of moral hazard to buyers as well as lenders: If a buyer need only scrape up $2,000 to buy a house, their losses are limited should they default to this same modest sum. Meanwhile, lenders working under the guarantee of FHA- and VA-backed loans are also insured against losses.

The Fed’s desire to boost home sales by any means available is transparent. By boosting home sales, it hopes to stem the decline of house valuations and thus stop the hemorrhaging of bank losses from writing down impaired loan portfolios, and also stabilize remaining home equity for households, which has shrunk to a meager 38% of housing value.

As many have noted, given that about 30% of all homes are owned free and clear, the amount of equity residing in the 70% of homes with a mortgage may well be in the single digits. (Data on actual equity remaining in mortgaged homes is not readily available, and would be subject to wide differences of opinion on actual market valuations.)

Broadly speaking, housing as the bedrock of middle class financial security has been either destroyed (no equity) or severely impaired (limited equity). The oversupply of homes on the market and in the “shadow inventory” of defaulted/foreclosed homes awaiting auction has also impaired the ability of homeowners to sell their property; in this sense, any remaining equity is trapped, as selling is difficult and equity extraction via HELOCs (home equity lines of credit) has, for all intents and purposes, vanished.

The Fed’s strategy, in conjunction with the government-owned and -operated mortgage agencies that own or guarantee the majority of mortgages in the US (Fannie Mae, Freddie Mac, FHA, and the VA), is to stabilize the housing market through subsidizing the cost of mortgage borrowing by shifting hundreds of billions of dollars out of savers’ earnings with ZIRP.

Since roughly 60% of households either already own a home or are ensnared in the default/foreclosure process, then the pool of buyers boils down to two classes: buyers who would be marginal if not for government subsidies and super-low mortgage rates, and investors seeking some sort of return above that of US Treasury bonds. The Fed has handed investors two choices to risk a return above inflation: equities (the stock market) or real estate. Given the uneven track record of stocks since the 2009 meltdown, it is not much of a surprise that investors large and small have been seeking “deals” in real estate as a way to earn a return.

Recent data from the National Association of Realtors concludes that cash buyers (a proxy for investors) accounted for 31% of homes sold in December 2011. Even in the pricey San Francisco Bay Area, where median prices are still in the $350,000 range, investors accounted for 27% of all sales. Absentee buyers (again, a proxy for investors) paid a median price of around $225,000, substantially lower than the general median price.

This data suggests that “bargain” properties are being snapped up for cash, either as rental properties or in hopes of “flipping” for a profit after some modest cleanup and repair.

Price and Risk Premium Discovery

There is one lingering problem with the Fed and the federal housing agencies’ concerted campaigns to punish capital accumulation, push investors into equities or real estate, and subsidize marginal buyers to boost sales at current valuations. The market cannot “discover” price or establish a risk premium when the government and its proxies are, in essence, the market.

By some accounts, literally 99% of all mortgages in the U.S. are government-issued or -guaranteed. If any other sector was so completely owned by the federal government, most people would concede that it was a socialized industry. Yet we in the US maintain the fiction of a “free market” in mortgages and housing.

To establish a truly free and transparent market for mortgages and housing, we would have to end all federal subsidies and guarantees/backstops, and restore the market as sole arbiter of interest rates — i.e., remove that control from the Federal Reserve.

Everyone with a stake in the current market fears such a return to an open market because it is likely that prices would plummet once government subsidies, guarantees, and incentives were removed. Yet without such an open market, buyers can never be certain that price and risk have truly been discovered. Buyers in today’s market may feel that the government has removed all risk from buying, but they might find that they “caught the falling knife;” that is, bought into a false bottom in a market that has yet to reach transparent price discovery.

So, the key question still remains for anyone who owns a home or is looking to soon own one…how close are we to the bottom in housing prices?

In Part II: Determining the Housing Bottom for Your Local Market, we tackle that question head-on. Because local dynamics inevitably play such a large role in determining fair pricing for any given market, instead of giving a simple forecast, we instead offer a portfolio of tools and other resources for analyzing home values on a local basis. Our goal is to empower readers to calculate an informed estimate of “fair value” for their own markets — and then see how closely current local real estate prices fit (or deviate) from it.

Click here to access Part II of this report (free executive summary, enrollment required for full access).

This article was originally published on chrismartenson.com.

Related articles

- A Simple Explanation Of The Federal Reserve Statement (January 25, 2012) (clewismortgage.wordpress.com)

- The Federal Reserve Meets Today: Mortgage Rates Expected To Move (edshort.wordpress.com)

- Deducting Mortgage Interest FAQs (turbotax.intuit.com)

- More homeowners staying current on their mortgages (freedommortgage.com)

- Federal Reserve Weighs In on Housing (eyeonhousing.wordpress.com)

- Homeowner tax code set to expire at year’s end (freedommortgage.com)

- Housing Help Will Run Up Against Lending Standards (blogs.wsj.com)

-

Fannie, Freddie overhaul unlikely, by Vicki Needham, Thehill.com

An overhaul of Fannie Mae and Freddie Mac is unlikely again this year despite recent Republican efforts to move the issue up the agenda.

Congressional Republicans, along with some Democrats — and even GOP presidential candidate Newt Gingrich — are renewing calls to craft an agreement to reduce the involvement of Fannie and Freddie in the nation’s mortgage market.

But without a broader accord, passage of any legislation this year is slim, housing experts say.

Jim Tobin, senior vice president of government affairs for the National Association of Home Builders, concedes that despite a mix of Democratic and Republican proposals, including a push by the Obama administration last year, congressional leaders probably won’t get far this year on a plan for Fannie and Freddie, the government-controlled mortgage giants.

Tobin said there are “good ideas out there” and while he expects the House to put some bills on the floor and possibly pass legislation, the Senate is likely to remain in oversight mode without any “broad-based legislation on housing finance.”

“We’re bracing for a year where it’s difficult to break through on important policy issues,” he said this week.

While the issue makes for a good talking point, especially in an presidential election year, congressional efforts are largely being stymied by the housing market’s sluggish recovery, prohibiting the hand off between the government and private sector in mortgage financing, housing experts say.

David Crowe, chief economist with NAHB, said that the market has hit rock bottom and is now undergoing a “slow climb out of the hole.”

The House has taken the biggest steps so far — by mid-July the Financial Services Committee had approved 14 bills intended to jump-start reform of the government-sponsored enterprises.

“As we continue to move immediate reforms, our ultimate goal remains, to end the bailout of Fannie, Freddie and build a stronger housing finance system that no longer relies on government guarantees,” panel Chairman Spencer Bachus (R-Ala.) said last summer.

Meanwhile, a number of GOP and bipartisan measures have emerged — Democrats and Republicans generally agree Fannie and Freddie are in need of a fix but their ideas still widely vary.

There are a handful of bills floating around Congress, including one by Reps. John Campbell (R-Calif.) and Gary Peters (D-Mich.), and another by Reps. Gary Miller (R-Calif.) and Carolyn Maloney (D-N.Y), which would wind down Fannie and Freddie and create a new system of privately financed organizations to support the mortgage market.

“Every one of those approaches replaces them [Fannie and Freddie] with what they think is the best alternative to having a new system going forward that would really fix the problem and would really give certainty to the marketplace and allow housing finance to come back, and therefore housing to come back, as well,” Campbell said at a markup last month.

There’s another bill by Rep. Jeb Hensarling (R-Texas) and bills in the Senate being pushed by Sens. Bob Corker (R-Tenn.) and Johnny Isakson (R-Ga.).

Corker, a member of the Senate Banking Committee, made the case earlier this week for unwinding government support for the GSEs while promoting his 10-year plan that would put in place the “infrastructure for the private sector to step in behind it.”

“A big part of the problem right now is the private sector is on strike,” Corker said.

He has argued that his bill isn’t a silver bullet, rather a conversation starter to accelerate talks.

“So what we need to do is figure out an orderly wind-down,” Corker said in November. “And so we’ve been working on this for some time. We know that Fannie and Freddie cannot exist in the future.”

He suggested getting the federal government this year to gradually wind down the amount of the loans it guarantees from 90 percent to 80 percent and then to 70 percent.

“And as that drops down, we think the market will send signals as to what the difference in price is between what the government is actually guaranteeing and what they’re not,” he said.

Even Gingrich, who has taken heat for his involvement with taking money while doing consulting work for the GSEs, called for an unwinding during a December interview.

“I do, in fact, favor breaking both of them up,” he said on CBS’ Face the Nation. “I’ve said each of them should devolve into probably four or five companies. And they should be weaned off of the government endorsements, because it has given them both inappropriate advantages and because we now know from the history of how they evolved, that they abused that kind of responsibility.”

In a white paper on housing last week, the Federal Reserve argued that the mortgage giants should take a more active role in boosting the housing market, although they didn’t outline suggestions for how to fix the agencies.

The central bank did argue that “some actions that cause greater losses to be sustained by the GSEs in the near term might be in the interest of taxpayers to pursue if those actions result in a quicker and more vigorous economic recovery.”

Nearly a year ago, Treasury Secretary Timothy Geithner asked Congress to approve legislation overhauling Fannie Mae and Freddie Mac within two years — that deadline appears to be in jeopardy.

The Obama administration’s initial recommendations called for inviting private dollars to crowd out government support for home loans. The white paper released in February proposed three options for the nation’s housing market after Fannie and Freddie are wound down, with varying roles for the government to play.

About the same time last year, Bachus made ending the “taxpayer-funded bailout of Fannie and Freddie” the panel’s first priority.

While an overhaul remains stalled for now there is plenty of other activity on several fronts.

In November, the Financial Services panel overwhelmingly approved a measure to stop future bonuses and suspend the current multi-million dollar compensation packages for the top executives at the agencies.

The top executives came under fire for providing the bonuses but argued they need to do something to attract the talent necessary to oversee $5 trillion in mortgage assets.

Earlier this month, the Federal Housing Finance Agency announced that the head of Fannie received $5.6 million in compensation and the chief executive of Freddie received $5.4 million.

Under the bill, the top executives of Fannie and Freddie could only have earned $218,978 this year.

Last week, Fannie’s chief executive Michael Williams announced he would step down from his position once a successor is found. That comes only three months after Freddie’s CEO Charles Haldeman Jr. announced that he will leave his post this year.

The government is being tasked to find replacements, not only for the two mortgage giants which have cost taxpayers more than $150 billion since their government takeover in 2008, but there is talk that the Obama administration is looking to replace FHFA acting director Edward DeMarco, the overseer of the GSEs.

In a letter to President Obama earlier this week, more than two dozen House members said DeMarco simply hasn’t done enough to help struggling homeowners avoid foreclosure.

The lawmakers are pushing the president to name a permanent director “immediately.”

Also, in December, the Securities and Exchange Commission (SEC) sued six former executives at Fannie and Freddie, alleging they misled the public and investors about the amount of risky mortgages in their portfolio.

In the claims, the SEC contends that as the housing bubble began to burst, the executives suggested to investors that the GSEs were not substantially exposed to sub-prime mortgages that were defaulting across the country.

Related articles

- Can anyone save Fannie Mae and Freddie Mac? (money.cnn.com)

- CEO who led Fannie Mae after government seizure to quit (usatoday.com)

- SEC Sues Former Fannie Mae And Freddie Mac Executives For Fraud (huffingtonpost.com)

- Fannie Mae CEO steps down during troubled times (agbeat.com)

- Fannie Mae CEO Steps Down, Despite Having “Long Way to Go in Housing” (inquisitr.com)

- The Future of Fannie Mae and Freddie Mac (money.usnews.com)

- Fannie, Freddie CEOs Took Millions, Far More Than Gingrich (pjmedia.com)

- Lawmakers slam Fannie Mae, Freddie Mac CEOs over pay and bonuses (latimesblogs.latimes.com)

-

Mortgage Slang 101 – Mortgage Insurance, Brett Reichel, Brettreichel.com

Mortgage insurance is viewed nearly universally as a bad thing, but in reality, it’s a tool to be used that is very good for home buyers, the housing market and the economy in general.

Why do many complain about mortgage insurance? Because it’s expensive, and sometimes difficult to get rid of when it’s no longer necassary. If that’s the case, why do I say it’s good for buyers and the economy? Because it’s a tool that allows people to buy a home with less than twenty percent down.

Mortgage insurance insures the lender against the risk of the buyers default on the loan. It does NOT insure the buyers life, like many people think.

The single biggest hurdle for home buyers is accumulating an adequate down payment. Lenders want buyers to put twenty percent down for two reasons. First, a buyer with a large down payment is less likely to quit making their payments. Second, if a buyer does default, the more the buyer put down usually means more equity in the house when the lender forecloses, which means the lender loses less money.

But, if a buyer wants to buy a $200,000 and has to put up a twenty percent down, that will equal a $40,000 down payment! Hard to save up, for most buyers. BUT, with the use of mortgage insurance, that buyer might be able to put as little as $6,000 down! A lot easier to save.

So, mortgage insurance can be a very benficial tool.

With that being said, don’t let your lender shoehorn you into only considering monthly mortgage insurance. There are other options such as single premium mortgage insurance, or “split” mortgage insurance. These programs can be more expensive up front, but sometimes much less expensive over time. They don’t work for everyone, but they certainly should be looked into.

Brett Reichel

Brettreichel.comRelated articles

- The Basics of Private Mortgage Insurance (choiceofhomes.com)

- Mortgage Insurer’s Bankruptcy Will Make It Harder To Get Loans (huffingtonpost.com)

- We Can’t Afford the Down Payment – What Down Payment? (adohomes.com)

- PMI Group files for Chapter 11 bankruptcy (seattletimes.nwsource.com)

- PMI Group files for Chapter 11 bankruptcy (sfgate.com)

- Mortgage Guaranty Insurance – Market Collapsing, Insurers Next?, by Gavin Magor, Weissratings.com (oregonrealestateroundtable.com)

- Mortgage Insurer Wilts (zimtelegraph.com)

- Mortgage Insurance Premium Deduction (MIP) Reminder (doraldigs.wordpress.com)

-

The Home Affordable Refinance Program (HARP): What You Need to Know, by Hayley Tsukayama, Washington Post

On Monday, the federal government announced that it would revise the Home Affordable Refinance Program (HARP), implementing changes that The Washington Post’s Zachary A. Goldfarb reported would “allow many more struggling borrowers to refinance their mortgages at today’s ultra-low rates, reducing monthly payments for some homeowners and potentially providing a modest boost to the economy.”

The HARP program, which was rolled out in 2009, is designed to help. Those who are “underwater” on their homes and owe more than the homes are worth. So far, The Post reported, it has reached less than one-tenth of the 5 million borrowers it was designed to help. Here’s a quick breakdown of what you need to know about the changes.

What was announced? The enhancements will allow some homeowners who are not currently eligible to refinance to do so under HARP. The changes cut fees for borrowers who want to refinance into short-term mortgages and some other borrowers. They also eliminate a cap that prevented “underwater” borrowers who owe more than 125 percent of what their property is worth from accessing the program.

Am I eligible? To be eligible, you must have a mortgage owned or guaranteed by Fannie Mae or Freddie Mac, sold to those agencies on or before May 31, 2009. The current loan-to-value ratio on the mortgage must be greater than 80 percent. Having a mortgage that was previously refinanced under the program disqualifies you from the program. Borrowers cannot not have missed any mortgage payments in the past six months and cannot have had more than one missed payment in the past 12 months.

How do I take advantage of HARP?According to the Federal Housing Finance Agency, the first step borrowers should take is to see whether their mortgages are owned by Fannie Mae or Freddie Mac. If so, borrowers should contact lenders that offer HARP refinances.

When do the changes go into effect?The FHFA is expected to publish final changes in November. According to a fact sheet on the program, the timing will vary by lender.

Related articles

- FHFA, Fannie Mae and Freddie Mac Announce HARP Changes to Reach More Borrowers (bespacific.com)

- Home Affordable Refinance Program (HARP II) Fannie Mae and Freddie Mac Refi Program (johnmurphyreports.com)

- Fannie Mae and Freddie Make Mac Move to NO Loan to Value Limit Loans on HARP (iloanminnesota.com)

- The Government’s Revamped HARP Program For Underwater Homeowners (clewismortgage.wordpress.com)

- New Rules Make it Easier for Underwater Borrowers to Refinance (chelseand.wordpress.com)

- Important Changes to Home Affordable Refinance Program (HARP) (theraleighmortgageguy.com)

- Are you Overwhelmed and Underwater? (bestfloridamortgage.wordpress.com)

- U.S. throws lifeline to underwater homeowners – Reuters (news.google.com)

- New refinance plan for underwater homeowners unveiled (sfgate.com)